I have great intentions but my to do list always seems to get in the way. I had hoped to post this last week but Halloween festivities took more time than I expected.

I have great intentions but my to do list always seems to get in the way. I had hoped to post this last week but Halloween festivities took more time than I expected.

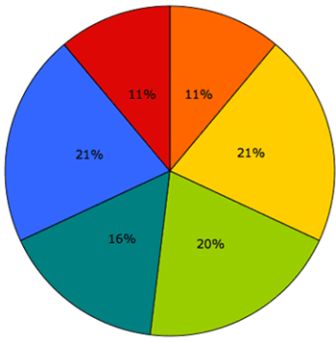

This week I want to touch on the importance of tracking your spending within specific categories. This is a great way to see where all of your money is really going each week. Would it surprise you if you found you spent more on entertainment and dining out than you spent on all of your utilities combined! When I first sat down to develop my budget, I found that entertainment expenses were at the top of my list of monthly expendatures!! It is amazing how fast those little things can add up!!

This is a super simple process and just requires you go a step beyond what we talked about last week in how to determine your spending. Just think of it as placing all your receipts into various piles based on categories. When all is said and done you will see how much money you spend on food each month, how much on entertainment expenses and so on.

You can create a few broad categories or even go so far as to break it all down into small sub categories. I find that the easiest way to do this is via a program like Mint.com or Quicken. Of course you can do it manually, it will just take a little more work to determine your end result 🙂

Ultimately you will have two broad categories that will encompass everything – necessities and luxuries. From there you can create a hierarchy and rate your categories by importance. I would hope that you would choose to make all the items in the necessities category more important than any of those in your luxuries category.

Once you know your spending within each of your categories, you can now start to attempt to modify your budget by creating limits and assigning specific amounts to be spent each month within your specified category. It may take you some time to play with your limits to get it just right.

Finding ways to decrease spending within specific areas can be tricky, especially some of the necessity areas but it can be done. Next week we will explore some of the ways to decrease spending in areas that appear fixed or difficult to modify!

Note: I am not a financial advisor. I am offering tips and ideas to help you stretch your monthly budget 😀

Good topic! Looking foward to next week, I do need help to reduce “fixed” expenses, I seems impossible.